Reconciliations, variance analysis and debtor management are time consuming tasks finance professionals juggle on a regular basis.

But did you know that there's a solution that makes these boring tasks incredibly easy?

Microsoft Copilot for Finance is the latest AI tool designed to help you reclaim time. It's like having an expert by your side, doing the laborious work so you can focus on driving business growth.

It's currently available as a free add-in for Excel 2016 onward and Microsoft 365 users with E3 or E5 licenses. Let me show you how you can use it to your advantage.

Table of Contents

Watch the Video

Download the Excel File

Enter your email address below to download the sample workbook.

Install Copilot for Finance Add-in

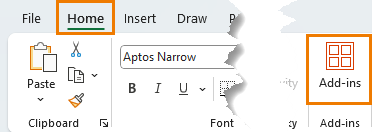

To install the Copilot for Finance add-in go to the Home tab > Add-ins > More add-ins:

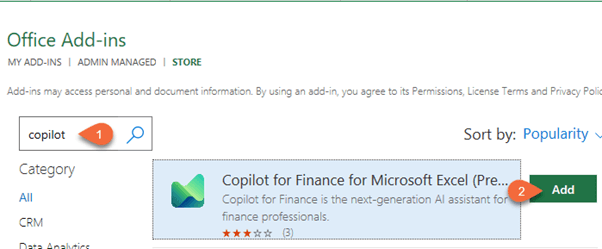

Search for 'Copilot'. Locate Copilot for Finance in the list and click Add:

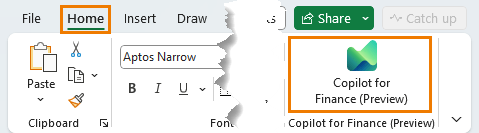

Once installed, you'll find the add-in available on the Home tab of the ribbon.

Note: Currently, the user interface for Copilot for Finance is available only in United States-based English (En-US). Additional languages and regions will be supported in future releases.

Copilot for Finance Reconciliations

The Copilot for Finance add-in enables you to effortlessly reconcile financial data by combining the power of AI with user-friendly functionality to maximize productivity, enhance accuracy, and reduce the time that's spent on manual processes.

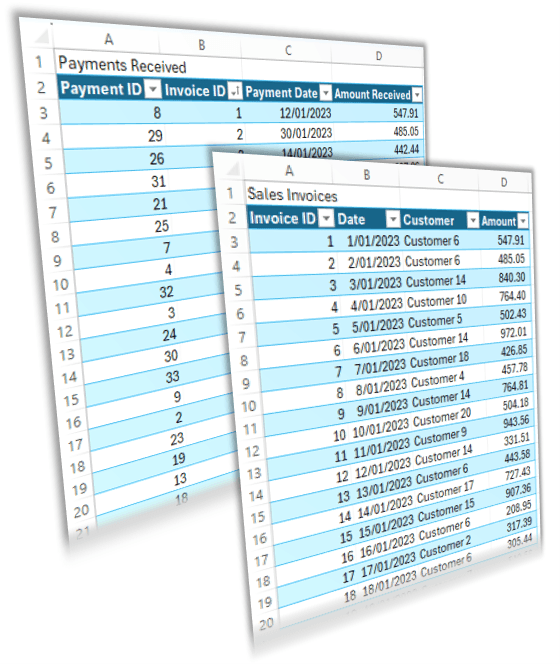

I provided it with two tables* of data and had Copilot reconcile them for me:

Note: Tables that are used for reconciliation shouldn't contain more than 10,000 rows and 30 columns.

*The data must be formatted in an Excel Table in the same workbook.

Step 1: Go to the Home tab > Copilot for Finance:

It opens in a task pane on the right-hand side.

Tip: you can left click and drag the task pane out to undock and resize it.

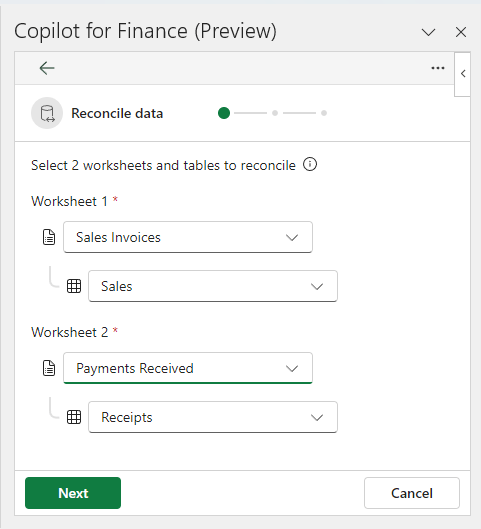

Step 2: select the sheets and tables I want reconciled:

Step 3: Create reconciliation rules.

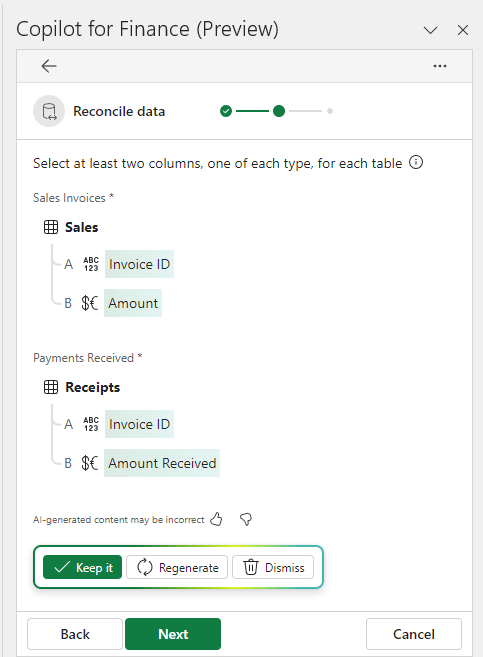

Copilot analyses the data structure and suggests a mapping for key types and monetary columns.

I can choose to keep them, regenerate them, or dismiss them and specify them myself.

I found Copilot got this right most of the time, but occasionally it also wanted to include the Date columns which wouldn't apply in my case. It's easy enough to get around by dismissing the suggestions and creating my own mapping parameters.

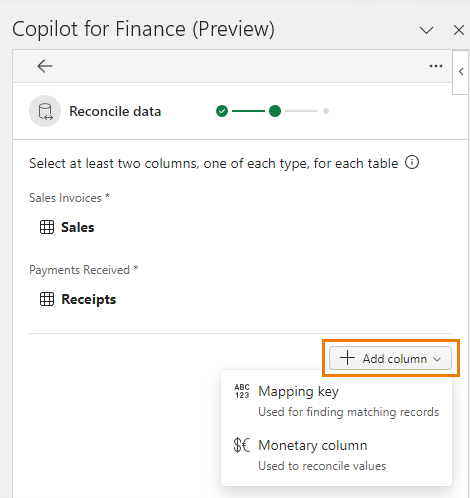

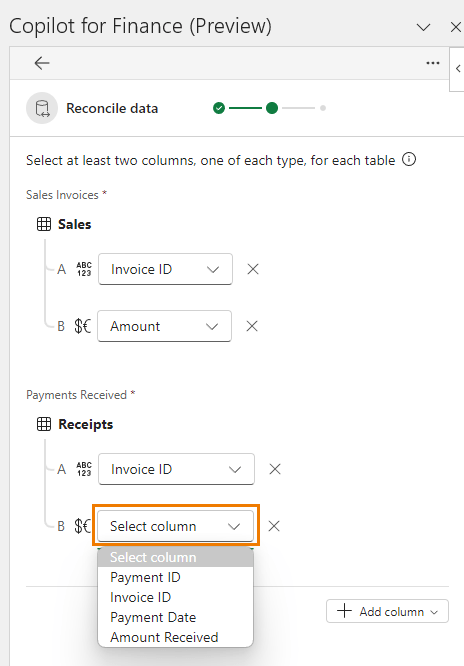

To specify them, start by selecting the mapping keys (you can choose more than one mapping key):

Then select the monetary columns:

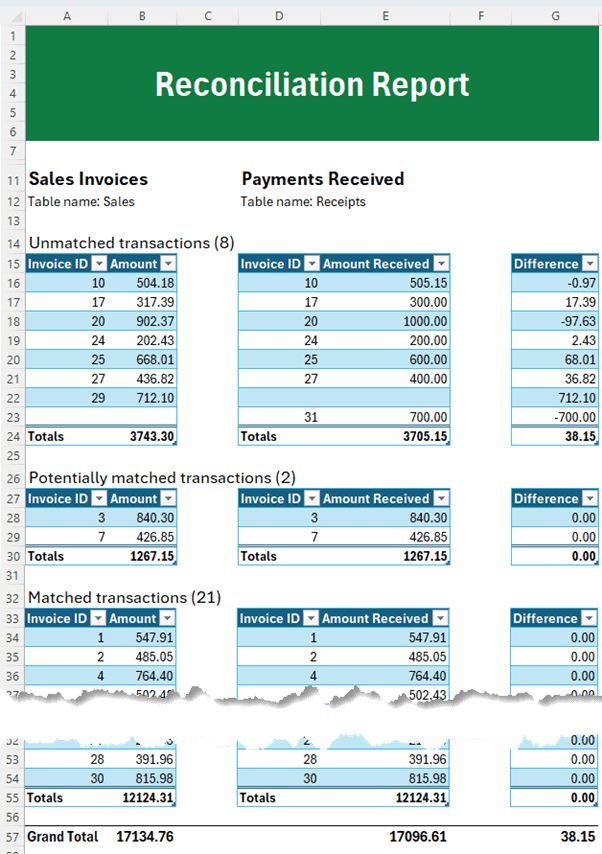

Step 4: Generate the reconciliation report. A new sheet is inserted with the reconciliation summary with transactions categorised into unmatched, potentially matched, and matched transactions.

Potentially matched transactions are those where multiple transactions add up to make a match.

From the report below, I only have 8 transactions that don't match and require further investigation.

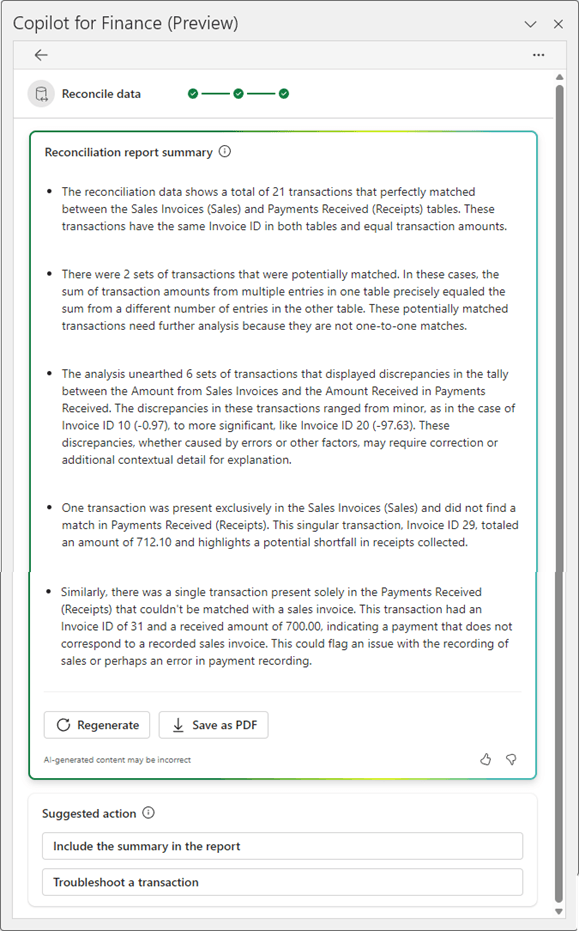

It also generates a reconciliation report summary which I could save as a PDF or insert it below the reconciliation tables in the Excel file:

Personally, I found this of little use. I'm tempted to copy it into ChatGPT and ask it to summarise it 😀

Note: if you do use this summary report be sure to check it thoroughly to ensure it's accurate.

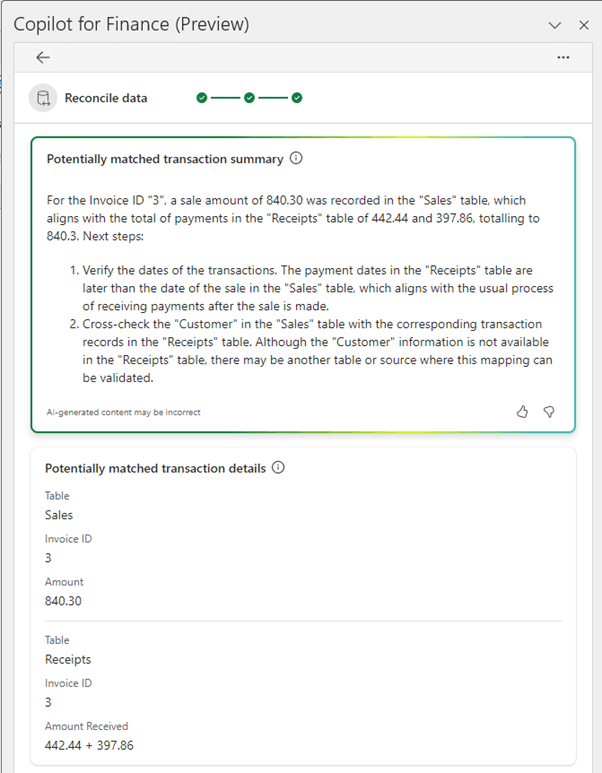

Troubleshoot a Transaction

Where I had unmatched or 'potentially matched' transactions, I could click on the cell I wanted to troubleshoot, and Copilot gave me a summary of the underlying values that make up the reconciled amounts. It also provided insights and suggestions for addressing inconsistencies in the report summary.

Copilot for Finance Variance Analysis*

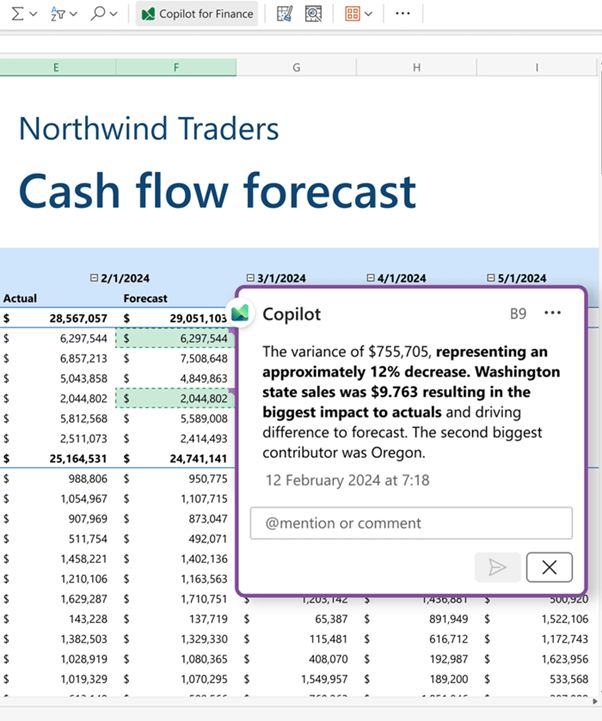

Copilot for Finance offers financial analysts a tool to reduce the likelihood of errors in reports and overlooked discrepancies. Instead of sifting through vast sets of financial data by hand to spot anomalies, analysts can prompt Copilot to identify outliers and highlight variances for further examination.

It simplifies the process of identifying variances by allowing for the use of repeatable natural language commands within a business setting. By instructing Copilot to find explanations for discrepancies, it autonomously compiles relevant supporting information.

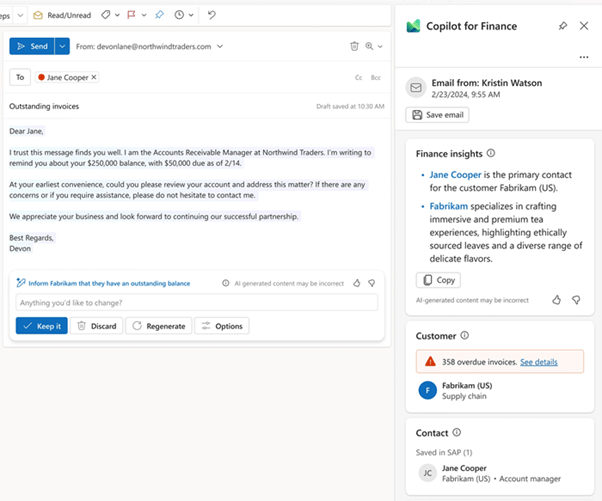

Copilot for Finance can also generate PowerPoint presentations, and emails to report to key stakeholders.

*At the time of writing Variance Analysis is coming soon.

Copilot for Finance Collections*

Accounts receivable is a vital task that impacts a company's cash flow, profitability, and relationships with customers. Collection coordinators dedicate their efforts to scrutinizing accounts with outstanding balances and strive to settle them promptly. This usually involves making phone calls, sending emails, and arranging payment plans. Copilot for Finance enables collection coordinators to shift their focus towards more impactful client interactions by handling the routine tasks. It aids the collections process end-to-end, from identifying high-priority accounts to summarizing interactions for entry into ERP systems and devising tailored payment arrangements for customers.

*At the time of writing debtor collection is coming soon.

Next Steps

If you're ready to try Microsoft Copilot for Finance, go ahead and download the add-in, or business users and tenant administrators can follow this deployment guide.

Find out more about the Microsoft Copilot for Finance preview here.

More Copilot: These are just a few of the problems that Copilot can solve. If you're interested in learning more about the most powerful productivity tool on the planet, check out what Copilot can do for you in Excel next. I'll see you there!