Master Excel to Drive Financial Insights and Investment Decisions

Develop practical Excel techniques for effective financial analysis.

In this course you’ll learn some of the techniques Dr Gottlieb teaches his Excel for Business Application class at Temple University, without having to actually attend a costly university. Learn how to leverage Excel tools for financial analysis, including:

- Time Value of Money functions

- What-if Analysis including Goal Seek and Data Tables

- Amortization and Depreciation

- And an introduction to the Solver

You’ll complete the course with a real business case study, where you'll apply Excel tools and functions to determine whether an investment fits within the financial objectives specified in the case.

Plus practice exercises for each session encourage you to fine tune what you learn.

And when you're finished we'll send you a Certificate of Completion to add to your résumé.

This course is ideal for accountants, executives or analysts that want to improve or refresh their skills and all levels of business school students.

Who is teaching the course

He was awarded a Microsoft Excel Most valuable Professional (MVP) for 2014 - 2016.

Dr. Gottlieb has taught Excel over 30,000 MBA, executive MBA, MS, PhD and undergraduate students at Columbia, NYU, Temple, and other universities. He has conducted numerous corporate seminars in the United States and abroad.

He is also the author of Next Generation Excel: Modeling in Excel for Analysts and MBA’s.

Course Prerequisites

The course is intended for all levels and does not require any specific knowledge other than basic Excel skills.

Course Syllabus

The course contains the following sessions:

- Time value of money

- What-if Analysis

- Future Value

- Amortization

- Depreciation

- A case study including the Solver

1. Time Value of Money

You will learn how to use the NPV, IRR, XIRR and XNPV functions to calculate the net present value and internal rate of return for projects and investments.

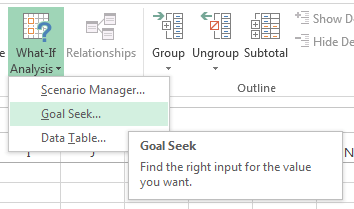

2. What-if Analysis

In this session we'll look at calculating the loan payments, total payments and total interest for loans. We'll use the Goal Seek tool to find out how much we could borrow if our repayment amount is limited, or interest rate was different.

3. Future Value

Calculate the future value of a series of payments over a period of time at a set rate. For example, if you wanted to know how much money you'd have if you invested $1000 every month for 6 years at 6% interest.

We'll also look at how to calculate the number of periods (e.g. years or months) you'd have to invest $1000 at 6% interest to get $60,000.

4. Amortization

In this session we'll look at how to use the PMT, PPMT and IPMT functions to create an amortization table for a loan.

5. Depreciation

We'll be covering 3 Excel Depreciation functions: SLN - straight line, SYD - sum of years and DB - declining balance. We'll look at how to use these functions to calculate the depreciation schedule for various assets.

6. Case Study

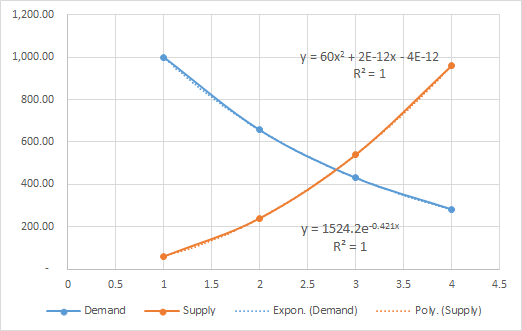

The case study will bring together the techniques already covered in the course. We'll also briefly look at how to use the Solver and fitting supply and demand curves.

Calculating Supply and Demand Curves in Excel

Choose Your Membership Level

Excel for Finance Online

USD $19Add to cart

USD $19Add to cart

12 Months Online

Online Only Access To Course

Course Videos 1hr 04mins

One Payment for 12 Months Access

Unlimited 24/7 access

Pause, rewind, replay

Download Workbooks and Practice Data

Certificate of Completion

30 Day Money Back Guarantee

Excel for Finance Download

USD $39Add to cart

USD $39Add to cart

12 Months Online + Download

Online Access + Download & Keep Course Videos*

Course Videos 1hr 04mins

One Payment for 12 Months Access

Unlimited 24/7 access

Pause, rewind, replay

Download Workbooks and Practice Data

Certificate of Completion

30 Day Money Back Guarantee

Notes

- Videos will be available for download after the 30 day Money Back Guarantee period ends. You can watch the videos online in the meantime.

- Membership and access to the training materials is for one person only. Logons are not to be used by multiple people.

- Downloaded videos are to be used only by the registered member, they are not to be transferred/shared amongst other people.

- *You can request a refund provided that no more than 30% of the course videos have been watched.