Hi! Can you please help me figure out how to calculate compensation using the below formula in excel: $25k per lemon fixed fee plus:

For 77 % of lemon sold goals = $3.5 per lemon price + 30% of net acquisition gain. Net acquisition fee is the difference between lemon revenue and marketing costs.

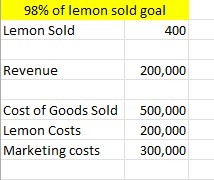

Metrics are:

77 % of lemon sold goal

% of lemon sold goal

Lemon sold is 400.

Revenue is 1,000,000

Cost of goods sold is 500,000

lemon costs 200,000

marketing costs 300,000

Hello,

Please upload a sample file with your data.

The numbers in your picture says one thing, what you write another.

If the sell price for 1 lemon is 25,000 and you sold 400, then the revenue should be 10,000,000 and not 1,000,000. And in your picture you state the revenue to be 200,000. It is quite mixed up as I see it.

Also, as I understand it, when calculating net income gain you would calculate revenue - all costs, in your example you only want to subtract the marketing costs, the purchase costs is not included, how come?

But with a sample file perhaps those question marks I have is answered, so please upload an excel file with some mockup data.

Br,

Anders